All Categories

Featured

Table of Contents

On the various other hand, if a client needs to attend to an unique needs youngster that might not have the ability to handle their own cash, a trust fund can be added as a beneficiary, enabling the trustee to take care of the circulations. The kind of beneficiary an annuity owner selects affects what the beneficiary can do with their inherited annuity and exactly how the proceeds will be tired.

Many agreements allow a partner to determine what to do with the annuity after the proprietor passes away. A spouse can change the annuity contract into their name, presuming all rules and legal rights to the first arrangement and postponing prompt tax repercussions (Annuity riders). They can accumulate all remaining payments and any survivor benefit and choose recipients

When a spouse comes to be the annuitant, the spouse takes control of the stream of repayments. This is understood as a spousal continuation. This stipulation allows the enduring partner to keep a tax-deferred standing and safe long-term monetary security. Joint and survivor annuities likewise allow a named beneficiary to take control of the agreement in a stream of repayments, instead of a round figure.

A non-spouse can just access the assigned funds from the annuity proprietor's initial agreement. Annuity proprietors can pick to designate a trust fund as their beneficiary.

Why is an Tax-deferred Annuities important for my financial security?

These differences mark which recipient will receive the entire survivor benefit. If the annuity owner or annuitant dies and the key beneficiary is still alive, the primary beneficiary gets the death advantage. If the key recipient predeceases the annuity owner or annuitant, the death advantage will certainly go to the contingent annuitant when the owner or annuitant passes away.

The owner can transform recipients at any time, as long as the agreement does not require an irreversible beneficiary to be named. According to experienced factor, Aamir M. Chalisa, "it is essential to comprehend the importance of designating a beneficiary, as picking the wrong recipient can have major consequences. Most of our clients pick to call their minor children as beneficiaries, usually as the primary beneficiaries in the absence of a spouse.

Proprietors that are married ought to not presume their annuity instantly passes to their partner. When selecting a recipient, take into consideration aspects such as your relationship with the individual, their age and how inheriting your annuity might influence their economic situation.

The beneficiary's relationship to the annuitant generally establishes the guidelines they adhere to. As an example, a spousal recipient has more alternatives for dealing with an acquired annuity and is dealt with even more leniently with taxes than a non-spouse beneficiary, such as a kid or other relative. Secure annuities. Intend the owner does choose to name a youngster or grandchild as a beneficiary to their annuity

How do I receive payments from an Retirement Annuities?

In estate planning, a per stirpes designation defines that, should your beneficiary die prior to you do, the recipient's descendants (children, grandchildren, et cetera) will obtain the fatality advantage. Connect with an annuity expert. After you've selected and named your beneficiary or recipients, you should proceed to review your choices at the very least once a year.

Keeping your classifications up to date can guarantee that your annuity will be managed according to your wishes need to you pass away suddenly. A yearly review, significant life occasions can trigger annuity owners to take an additional appearance at their recipient choices.

Who should consider buying an Variable Annuities?

As with any economic product, seeking the help of a monetary consultant can be helpful. A monetary organizer can assist you through annuity management procedures, consisting of the approaches for updating your contract's beneficiary. If no beneficiary is named, the payment of an annuity's survivor benefit goes to the estate of the annuity owner.

To make Wealthtender totally free for readers, we generate income from marketers, consisting of economic professionals and companies that pay to be featured. This produces a conflict of passion when we prefer their promotion over others. Read our content plan and regards to service to read more. Wealthtender is not a customer of these financial providers.

As a writer, it is among the very best praises you can offer me. And though I truly value any of you investing some of your busy days reading what I compose, clapping for my write-up, and/or leaving appreciation in a comment, asking me to cover a topic for you really makes my day.

It's you saying you trust me to cover a topic that is essential for you, and that you're positive I would certainly do so better than what you can already find on the Web. Pretty stimulating things, and a responsibility I do not take likely. If I'm not aware of the subject, I investigate it on the internet and/or with calls who recognize even more regarding it than I do.

Why is an Secure Annuities important for my financial security?

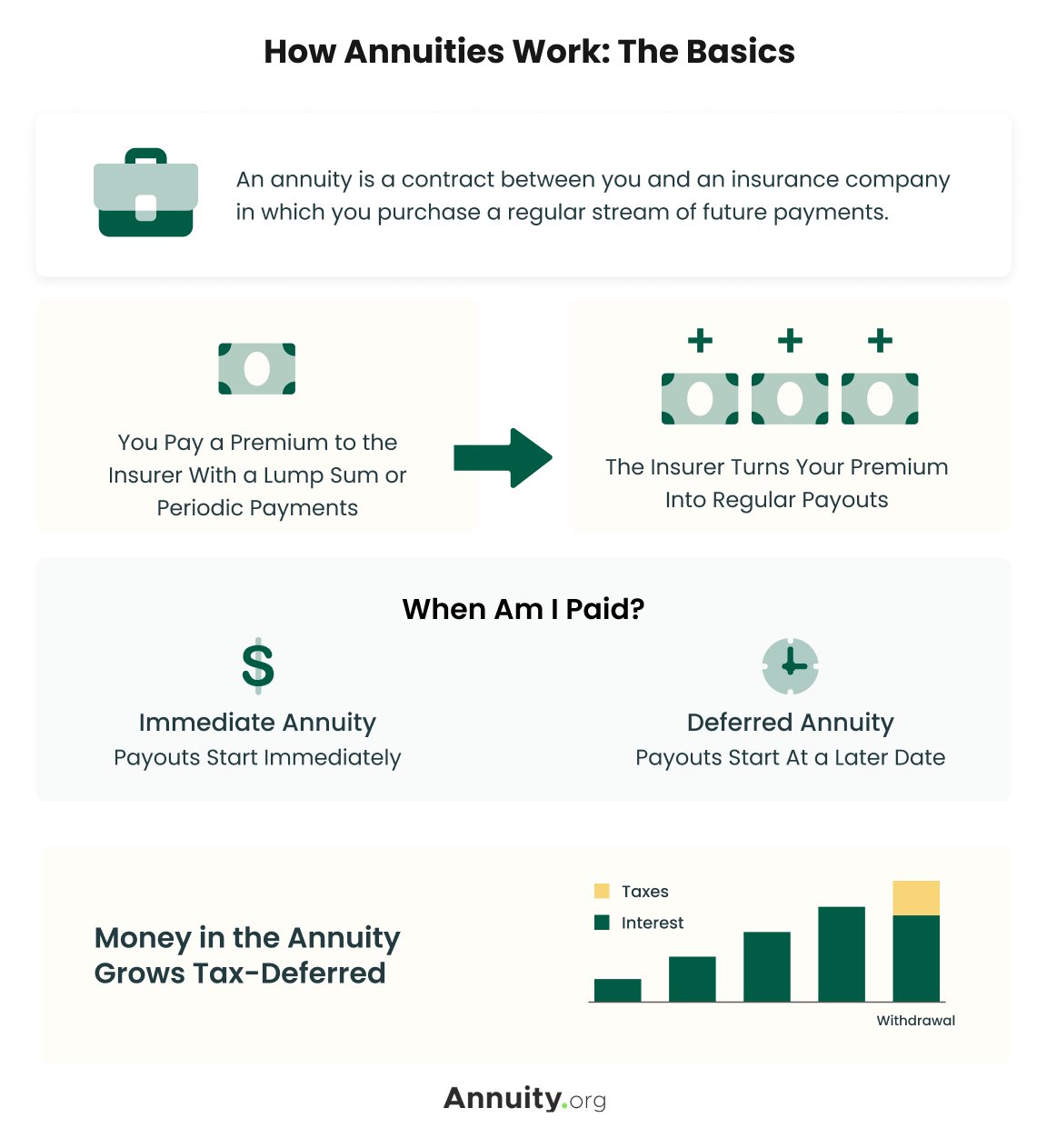

Are annuities a legitimate referral, a shrewd action to secure guaranteed earnings for life? In the easiest terms, an annuity is an insurance policy product (that just qualified representatives might offer) that ensures you regular monthly payments.

This usually applies to variable annuities. The more cyclists you tack on, and the less threat you're willing to take, the reduced the repayments you must anticipate to receive for a given costs.

How do I cancel my Fixed Vs Variable Annuities?

Annuities chose correctly are the right choice for some people in some situations., and after that number out if any kind of annuity alternative provides enough advantages to justify the costs. I used the calculator on 5/26/2022 to see what a prompt annuity could payment for a single costs of $100,000 when the insured and partner are both 60 and live in Maryland.

Table of Contents

Latest Posts

Decoding Fixed Income Annuity Vs Variable Growth Annuity Key Insights on Fixed Annuity Vs Variable Annuity What Is Variable Vs Fixed Annuities? Features of Fixed Indexed Annuity Vs Market-variable Ann

Breaking Down What Is Variable Annuity Vs Fixed Annuity A Closer Look at How Retirement Planning Works Breaking Down the Basics of Tax Benefits Of Fixed Vs Variable Annuities Features of Fixed Indexed

Decoding What Is A Variable Annuity Vs A Fixed Annuity A Closer Look at Fixed Income Annuity Vs Variable Growth Annuity Defining the Right Financial Strategy Benefits of Choosing the Right Financial P

More

Latest Posts